|

2 likes

1 comment

share |

12 min reading time

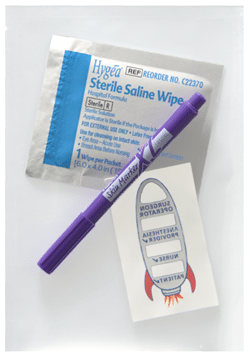

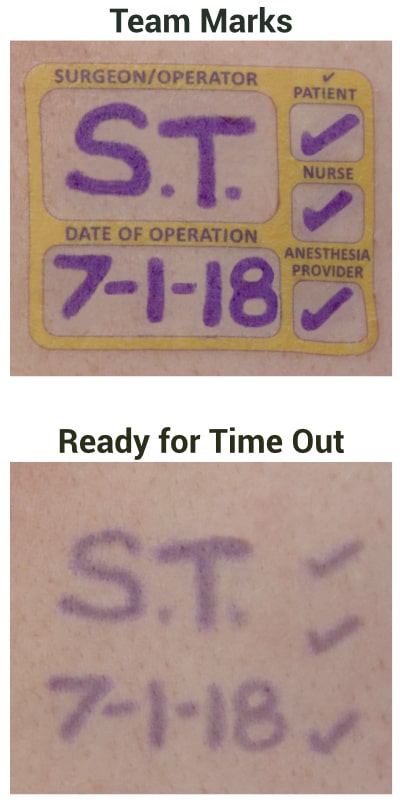

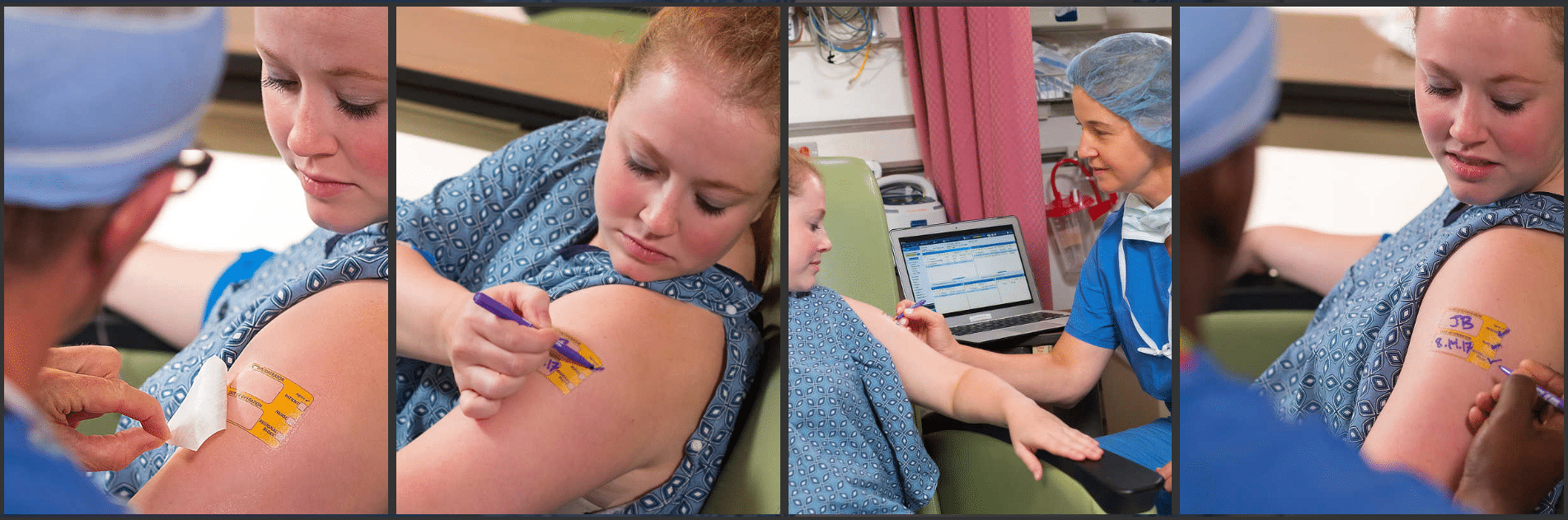

I begin this conversation with a question: Which factor have you found to be most important in terms of setting a purchase price for a successful market launch: Hospital bundling, a desire on the part of the surgical/medical staff for the device, or something else? The anesthesiologist’s inventionI helped anesthesiologist Wade Goolishian launch his Surgi-Sign temporary tattoo two years ago. Its purpose is to prevent wrong-side surgeries, an occurrence far more frequent than you’d think. In fact, it happens 40 times each week in the United States.

How would you price it?Before he launched, we did a little crowdsourcing to help answer the pricing question. We specifically asked,

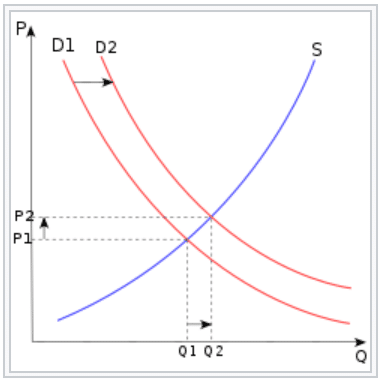

This is what our beloved community said. Do you agree with them? Do you have an alternate view? Dave Sheppard, CMAA, Global M&A, OutSourced B,D&L Leader for SME (Small and Medium Enterprises) & Emerging Technology Healthcare Companies, said: Hi Joe – As you know, there is so much more to the answer to that question than simply price. He can be $1.50 and never get an order. He could also be $4.00 and dominate the market. It takes a deeper analysis of the market segment, his product differentiation, the reimbursement involved, his brand AND “Last but not least”- the strength of his channel partner. And it’s important to remember – that when one wins on price alone – one also loses on price. For example, if he enters at $2.75 and wins some business, it’s likely his competitors will drop their prices to $2.70…and so on and so forth. Therefore, it’s important to have a comprehensive strategy that includes price, brand, product differentiation, and CHANNEL. With all that stated, of course, he can do some market research to help validate an entry price point. As it often costs money for a hospital to change suppliers, he’ll need to understand if it will take a 10%, 20% or ?? discount to get movement. (Hopefully, his product differentiation and value proposition will minimize the need for too much discounting.) Mark C Adams, MBA, Medical Device Leader/Executive, said: “You’ll need to consider the size of the buy; will they buy in bulk? You’ll need to learn if a group purchasing organization is involved because doctors would have to write an exclusion letter to circumvent the buying contract. And if the disposable is from a huge company, bundling may impact the real unit price.”

Editor’s Note: The inventor replied, “Since the device is intended to be used on 100% of patients undergoing procedures and not directly attributable to any specific patient, I expect the hospital will bundle the cost into the surgical payment. This is supported by a deliberate exclusion for similar devices in the HCPCS coding. Bundling would drive the price down as hospitals seek a discount.” Jon Wait said: At $3.00 it’s already a commodity. He needs to align himself with the large distribution companies. Unless it’s revolutionary and/or there is an ICD-10 code he should price it at the low-average as any high price will only blockade his launch. Tony Moses, CEO of Eyecheck, said: “I would suggest a head to head comparative study to the $3 product to show any significant benefit or difference. Ultimately, the market will determine the price but perhaps the benefits support a price well above $3.” P.K. Koduri, Manager of Global Market Outlook for Cook, said: Is the problem really an issue for other physicians? Does it save time or other resources? Data to back up the benefits? If the answer is yes to all of the above then definitely price it at a premium. It’s always easy to adjust pricing downwards if adoption is slow.

Commercialization Strategist Pascal Gand said: “If there is any clear evidence about real competitive advantage that would make the life of the users better, then the inventor can shoot for some premium positioning. Not sure the first reaction of the competitors will be to drop prices and engage into a price war. They may prefer to send a business development team instead.” Ana Ferreira, Director at Chemring Group PLC, said: “How much time do you have?? Actually, there are multiple assessments that should be done, and I won’t go into them here, but suffice it to say there is no “one size fits all” though some very common considerations come to mind. Also, some interesting comments posted here.” Remi Corlin, VP International Markets at HemoSonics, said: “It would be nice to understand what the inventor strategic objectives are. Is he looking for a quick exit, or rather building a sustainable business? What is the investment available to support the launch?

Martin Lee, General Manager at Dynamic Thermal Technologies Pty Ltd, said: “I don’t know what it is! I agree with Jon. Set the entry price at $3.00. Make it easy for the distribution system to move it in! And if it’s a transforming technology, it’s a win-win. cheers.” Andrew Wiltshire, Senior Director, Market Access, Public Affairs & Policy at Medtronic, said: “One of the things least appreciated by payers and commentators on device pricing is the risk taken by the manufacturer. Hopefully this device is very low risk and well designed and quality manufactured. But even so if something goes wrong (and it does) and a recall is required and patients injured there is a lot of cost and liability on that. For a large diverse company that risk can be spread across the portfolio although it is no less real. The smaller the company and the narrower the portfolio and revenue base the more acute the risk is. in Medtech R&D, Manufacturing and Marketing/Distribution/Channel costs are not the only things that need to be considered in the price, risk is also a big factor.” Luis Heredia, MSc, CQT Founder & Program Managing Director, said: “Hello Joe, I will depart from traditional approach described here. I will propose win-win situation to my prospective clients, discounted price based on purchased volume. I will start at $3.10 ($0.10 for the value added compared to the device has over the top competitor), then provide to client’s percentage discounts up to the 50% of my profit margin (Mfg cost+Bus.Operation, etc) this way, I will let the client establish it’s own price based on surgeries forecasting. In my offer, I will include buybacks excess of expired inventory with credit for new purchase.” Don Kloos, Business, Market, and Product Development: Medical Device and Retail Healthcare / Scientific Instruments, said: “Does the developer have IP and is it solid? Presuming he does, a rule of thumb for an entry impact I was taught was 10X the performance at same price, or equal performance for half the price. If the new product provides significant and perceived cost, safety, outcome benefits that are substantial and also covered under the hospital’s procedure bundle, an equal price is merited at least. At $1.20 COGS, I don’t see how low pricing can work out considering the multiple channels and margins required. Even if superior, getting it through channels and into OR is the real challenge.” Stephen Griffin, Founder and CTO of InnovaQuartz and Cyclone Biosciences, said: “Unless this hypothetical product provides great value over the competition, in terms of reduced costs/time in the OR, justifying a significant premium over the existing solution, that is unless the device can command a significant premium relative to the $3 device, the answer is simple: drop it. He’ll never make any money at $3 if the $1.2 COG cannot be reduced by economies of scale.” Mike Stanicek, VP of Product Management at 3D Systems Corporation, said: “Pricing is dictated by IP protection, unique value proposition against competitive alternatives, and channel strategy. If possible do some test marketing at different price points in some exclusive regions. Talk to your potential customers and customers using the competitive alternatives to test the value of the product to validate the benefits. At the end of the day, you are solving a problem that has value. Define the problem and describe how you are better than the competition in solving it. Then price accordingly to either own the premium point based on unique value or price competitive to gain share with a solid channel strategy that most effectively reaches your target customer. I would be happy to help you through this process. Good Luck!”

Anthony Zelinko, CEO/Owner Bonte’ Medical Supplies, Inventor, Polymath, Visionary, said: “Hi Joe, I would first do a cost vs benefits analysis and adjust accordingly. On the benefit side you must consider a time saver as a major price driver if this is the case then the device not only can demand a higher premium but can justify it too. Ask yourself how much time is a physicians time worth? Depending on how much time is saved and it’s ancillary benefits would dictate it’s market value. If I had to guess as mentioned it’s a commodity I would not price it less than 3X it’s manufacturing costs. I have my reasons but I would end up posting a full blown treatise and this is just a comment section.” Michael Meyers, Consultant and Scientific Advisor at PAION AG, said: “Funny, I am an anesthesiologist with a radical new product to replace a current product that has been around for 40 years. My product does everything better and faster and safer. The major company I am dealing with for sales and distribution has already informed me that I have to be price competitive with the current inferior product no matter how superior my product is in order to obtain a position in the market. Then, if I am disruptive enough, I can slowly raise the price as the benefits of my product are realized, but displacing a current market is tough unless you start price competitive.” Ilsa Webeck, Principal and Founder of MedTech Strategies, said: “The items listed already are important to consider, however you need to look at the big picture and simply charging the price of the competition is short sighted. What is the cost of the procedure and the other components used? Who is paying for it and from what budget? What other factors come into the play? (Does it take more shelf space, need a different complimentary product that they don’t already use today?). Does your product save money in other ways? (Lower procedure cost due to shorter time needed, less staff time, less co-morbidities)? Just some questions I would want to answer and would do so through asking the users and the buyers to get their input.” Spencer Lee, Owner at Spencer Lee Marketing, said, “Sell it and take a royalty. At those margins…the cost of building distribution will put him out of business before he can get any serious kind of adoption. been there, done that.” Rainer Moosdorf, MD, PhD, FAHA, Cardiovascular Surgeon, Medical Consultant, Member of Healthcare Shapers, said: “In fact there are significant differences between for example the American and the German market. In Germany, the costs for most (disposable) devices are included in the respective DRG for a certain treatment. If You come up with a new device, the price should not (significantly) exceed the one of the existing product, otherwise You may be running into a deficit. This is especially true for high price or high frequency products. One exception is of course a new product, which is so much better that You can´t withhold it from your patients and/or it is an advertisement for your hospital. Let me add one personal experience. One argument, which I hear frequently is that the more expensive new product may be limited for certain indications. If it is a device you daily use in your routine practice a couple of times, it is hard to define these “certain” indications” and, even more, to make sure that every team member adheres to them. Many such devices are forgotten then.” Mark McLaren, Freelance International Sales, Marketing and Branding, said: “If the product is not unique but in fact an improvement on an already available product then I’d suggest research and due diligence regarding the claims and potential patents. Then approach the current market leader to negotiate.” Roger Cepeda, JD, MBA, RAC, Medical Device and Biotech Attorney, said: “I’m not a pricing expert, but can relay what I’ve seen at global firms plus a similar project I’m looking at now where a physician has 510(k) clearance, IP protection, and is looking to monetize the device. In the case of the anesthesiologist’s invention, we need to know the “buyer.” If, for example, he’s selling it all to Cardinal Health, that’s different than trying to sell it directly to end users, which would mean he’ll retain manufacturing and quality obligations (outsourced, I assume). I agree with others that developing the “value proposition” is the main issue, and that needs to be tailored to the buyer. If this will be embedded in a DRG or existing payment that competes for a piece of the hospital’s technical component, then you may need a healthcare economics-type study. Discounts below $3 should only be in exchange for early adopters who help with commercialization and for buyers who agree to minimum purchase commitments or % of needs.” Seema Jaiswal, Product Management, Non-profit Strategic Consulting, said: It needs to be a comprehensive approach – what are the goals of the company (in this case I believe it would be to gain market share), what is the differentiation and value proposition, what the competition is doing and market research on how much would the customers be willing to pay for the product. As Dave mentioned, you also have to consider the cost to switch to your product and overall impact/benefits on the operations by switching over.” John Riles, VP Business Development & Strategy, said: “Not a lot of experience with low price commodities, but it feels like a non-starter if you can’t justify a premium price price of $4.00 or better. My guess is the $1.20 COGS estimate assumes success and requires a certain volume to achieve that target. I’d rather fall flat on my face early-on rather than price a product so low that a profit remains elusive and impossible.” Did you learn something today?Are you struggling with pricing and competitive questions? You’re welcome to contact me directly to discuss with me or someone in our vast community. And if you found it valuable, please share it with your network on LinkedIn. The Combination Products Market

Read it for commercialization tips for your combination product. Related: This year’s Combination Products Forum will be 22-24 October 2019 in Berlin, Germany. Fast Round about Medical Device M&AWe introduced a new concept at 10x this year called “Fast Rounds.” Fast Rounds recognize each guest is an expert – even if we don’t have time to feature each as a speaker. I spent time with Daniel Sheppard, Managing Director of MedWorld Advisors. You’ll want to talk with him if you want to increase your enterprise value ahead of a sale. Click here if you’d like to be considered as a future Fast Round participant. Our subscribers have questions. 🤔 Can you answer them?David Otto asks, “How to break into medical device sales as an older professional?” Szymon Krzemiński has a question about “Private Label Requirements, Manufacturer’s Registration & Initial Importers.” Mahamad Shafi asks, “Is there a specific timeline to update the Class I and Ir device labels?” Thank you for being part of our Medical Devices Group community!Please Make it a great week.

Joe Hage P.S. I spend at least five hours to prepare each of these for you. Please share them so they help the most people? I will appreciate it very much. Marked as spam

|

Meet your next client here. Join our medical devices group community.

Private answer

Joyce Dunsmore

Regarding the tattoos - My mom had a broken hip that remained intact and didn’t hurt enough to need pain meds, until a very poor health care giver rolled her over on it and dislocated the fracture. It’s a long story of poor health care that ultimately ended up with her having her left leg amputated to the knee. I used a permanent marker on the good leg and wrote in large letters, “NOT THIS LEG”. The surgeon was furious with me, to imply he would remove the wrong one. Well obviously, the article below shows that even if she had been in a part of the US where the health care is better, I was absolutely correct in doing that. Marked as spam

|

We still use LinkedIn to access our site because it’s the only way to “pull in” your LinkedIn photo, name, and hyperlink to your profile page, all vital in building your professional network. When you log in using LinkedIn, you are giving LinkedIn your password, not me. I never see nor store your LinkedIn credentials.

He later added, “Doctor-inventors ALWAYS think that every single physician and hospital on the planet will just start buying their widget. If it was that easy sales and marketing departments wouldn’t exist. Even with a disposable commodity there has to be a strategic, targeted plan. The obstacles are many: physician education, hospital purchasing, GPO circumvents, nursing cooperation. As a guy with 25 years experience in startups and restarts I can tell you from first hand experience that this inventor needs a Top 10% marketer, a large strategic distribution partner and most importantly to remove himself from the business aspect of launching his widget. Doctors make terrible sales people.”

He later added, “Doctor-inventors ALWAYS think that every single physician and hospital on the planet will just start buying their widget. If it was that easy sales and marketing departments wouldn’t exist. Even with a disposable commodity there has to be a strategic, targeted plan. The obstacles are many: physician education, hospital purchasing, GPO circumvents, nursing cooperation. As a guy with 25 years experience in startups and restarts I can tell you from first hand experience that this inventor needs a Top 10% marketer, a large strategic distribution partner and most importantly to remove himself from the business aspect of launching his widget. Doctors make terrible sales people.”